tucson sales tax on food

Tucson Estates AZ Sales Tax Rate. Effective July 01 2009 the per room per night surcharge will be 2.

The Coupons App 1 Most Popular Download For Android Iphone Fast Food Coupons Free Printable Coupons Printable Coupons

The City of Tucson receives 2 tax from all taxable sales by businesses located within the city limits regardless of the customers location.

. Effective July 01 2003 the tax rate increased to 600. As you can see to obtain a foodbeverage tax in Tucson Arizona FoodBeverage Tax you have to reach out to multiple agencies at various levels of government including federal state county and local level offices. Tumacacori AZ Sales Tax Rate.

South Tucsons food tax dates back to at least 1995. Tucson AZ Sales Tax Rate. Or within parking areas for in-car consumption.

While Arizonas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. If you itemize tax separately on your customers receipts and keep records of it on your books you may take the actual tax collected as a deduction. 1 hour agopotholes in pima county.

WHO RECEIVES THE RETAIL SALES TAX. Tusayan AZ Sales Tax Rate. Tumacacori-Carmen AZ Sales Tax Rate.

The minimum combined 2022 sales tax rate for Tucson Arizona is. Wayfair Inc affect Arizona. If you do not separately.

07-07-2019 0942 PM exit2lef. Food served by an attendant to be eaten at tables chairs benches etc. Did South Dakota v.

The subreddit for Tucson Arizona. 411 funds would go toward repaving Tucsons streets. Groceries are exempt from the Tucson and Arizona state sales taxes.

The following cities in the Phoenix metro that do have a sales tax on food are the following. Sahuarita Sedona Superior Surprise Tombstone Tucson not including the municipality of South Tucson which does tax groceries Tusayan Williams. TUCSON KVOA - The half-cent sales tax that funds street improvement projects in the city of Tucson is expected to.

At a council meeting Monday Basha suggested that a reconsideration of the citys 25 percent tax on food for home consumption could help ease the pain. You can print a. Cutting the food tax will.

There is no applicable special tax. To learn more see a full list of taxable and tax-exempt items in Arizona. Tucsons sales tax rate is 26 which is over 1000 on a typical new car.

Axe the Food Tax Bill will completely eliminate the states sales tax on groceries by 2025 On Wednesday May 11 Governor Laura Kelly signed bipartisan legislation House Bill 2106 that will Axe the Food Tax eliminating the state sales tax on groceries. The sales tax jurisdiction name is Arizona which may refer to a local government division. The County sales tax rate is.

Tucson voters will vote on Proposition 411 which would extend the citys half-cent sales tax. 14 hours agoProp 411 would repair cracked neighborhood streets across the city of Tucson by extending an existing half-cent sales tax for another 10 years. Vehicle purchases can be made at Jim Click Ford in Sahuarita Oracle Ford in Pinal County in Nogales and of course at Casa Grande and Phoenix dealers.

The Tucson sales tax rate is. 39 minutes agoTue 05172022 - 2231. This is the total of state county and city sales tax rates.

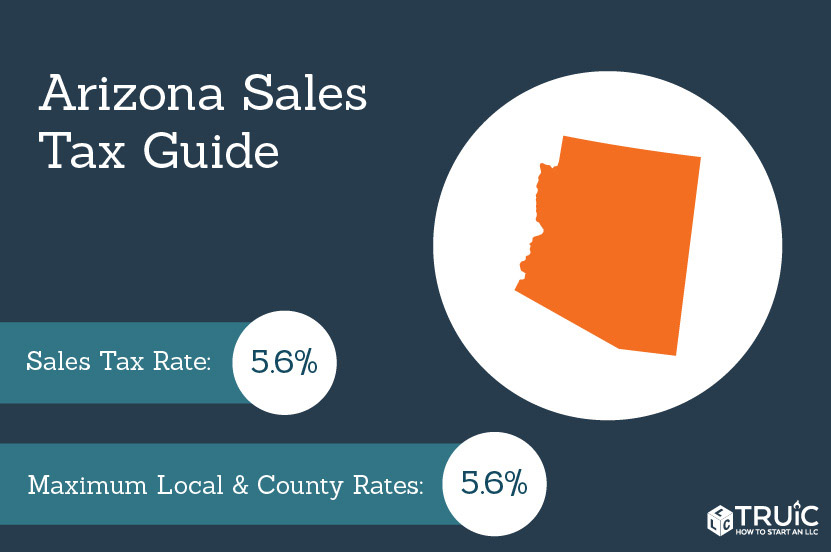

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. Tucson collects a 3 local sales tax the maximum local sales tax allowed under Arizona law. What is the sales tax rate in Tucson Arizona.

Press J to jump to the feed. The December 2020 total local sales tax rate was also 8700. Tubac AZ Sales Tax Rate.

Tucson is a city in Arizonas Sonoran Desert surrounded by multiple. Tucson and Mesa tax food. Currently the City of Tucson receives 2 percent retail sales tax.

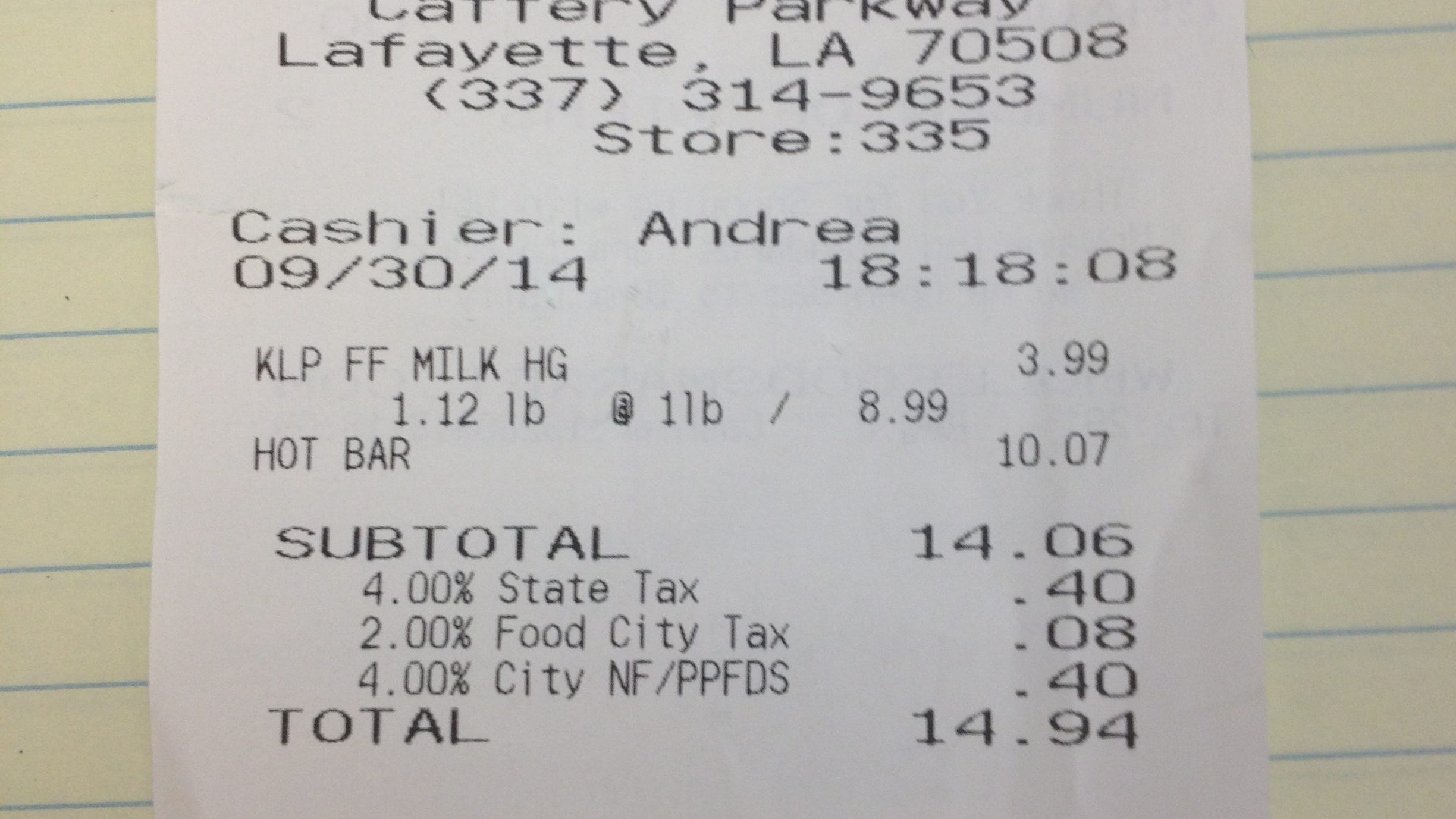

Prepared food including hot meals or deli meals like sandwiches are generally always taxable in Arizona. 1-800-870-0285 email protected. On May 17 the city of Tucson is holding an all-by-mail special election.

The Arizona sales tax rate is currently. City voters will decide Tuesday on whether to. Sales Affiliates and Partnerships.

The current total local sales tax rate in Tucson AZ is 8700. Officials say 80 of the Prop. When were in a 1 percent business.

Food sold within the premises of theaters exhibitions concerts places of amusement and any businesses that charge. Tucson AZ Sales Tax Rate. 7 hours agoUpdated May 17 2022 206pm.

Tucson has a lower sales tax than 571 of Arizonas other cities and counties. Gilbert 15 percent Chandler 15 percent Peoria 16 percent. Vaiva Vo AZ Sales Tax Rate.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. And Tucson considered a food tax in 2010 but the city council rejected the proposal. Vail AZ Sales Tax Rate.

Utting AZ Sales Tax Rate. Groceries and prescription drugs are exempt from the Arizona sales tax Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 10725. Only nine Arizona cities and towns have lower retail sales tax rates.

Tina Giuliano Posted at 639 AM May 17 2022. 683k members in the Tucson community. Unlike many other cities and towns in the state Tucson does not collect retail sales tax on food or residential rentals.

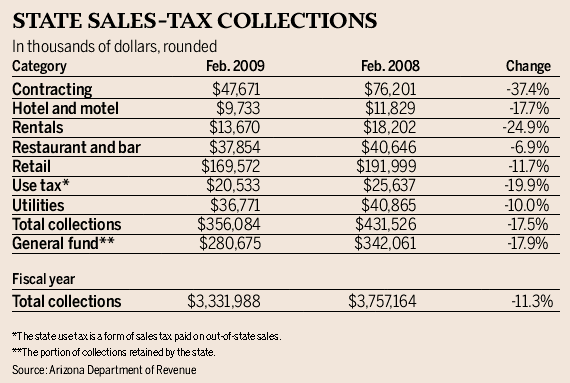

Seventy of the states 91 incorporated cities and towns charge a sales tax on groceries said Ed Greenberg spokesman for the Arizona Department of Revenue. Its sales-tax revenue fell from 21 million in fiscal year 2008 to 18 million in fiscal year 2013 and the largest share comes from the retail trade category that includes the food tax. This page describes the taxability of food and meals in Arizona including catering and grocery food.

Imposes a 400 transient rental tax on rent from persons renting accommodations for less than 30 consecutive days and a 1 per night charge per room rented but not as a part of the model tax code.

Is Food Taxable In Arizona Taxjar

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Is Food Taxable In Arizona Taxjar

Arizona Sales Tax Collections Fell A Sharp 17 5 In February Business News Tucson Com

Borderlands Food Bank Nogales Az 85621 Reduce Food Waste Nogales Food Waste

Whole Foods Collecting The Right Amount Of Sales Tax

Arizona Sales Tax Small Business Guide Truic

Arizona Sales Tax Small Business Guide Truic

Culver S Tucson Az Food Crispy Chicken Sandwiches Best Fast Food Burger

3 99 For A Qt Lunch Bye Waffle House So Hot And Tasty Waffle House Quick Meals Thank You Come Again

Restaurants And Bars Arizona Department Of Revenue

Is Food Taxable In Arizona Taxjar

The Best Way To Avoid The Gift Tax Do Not Give Gifts That Exceed 15 000 Per Person This Year Holiday Feeling Appreciated Tax Services

Artistic And Quirky A Walking Tour Of Barrio Viejo In Tucson Local News Tucson Com Walking Tour Texas Rangers Tucson

Help Pay Our Gas Bill Gas Bill Go Fund Me Las Vegas

Food City Weekly Sales Food City Sour Cream Apple Pie Food Meal Planner

How Much Is The Tax On Restaurant Food In Arizona Santorinichicago Com

Ramchandra Proposed I 11 Interstate Wickenburg Interstate Highway

The Ultimate Breakfast Served By My Friend The Beautiful Kc Villageinn Ultimate Breakfast Food Breakfast